Reasearch & Development(“R&D”) as a Service

Initial research

- https://www.globalspec.com/learnmore/engineering_technical_services/research_development_services

- https://www.investopedia.com/terms/r/randd.asp

- https://dac.digital/research-and-development-as-a-service-product-engineering/

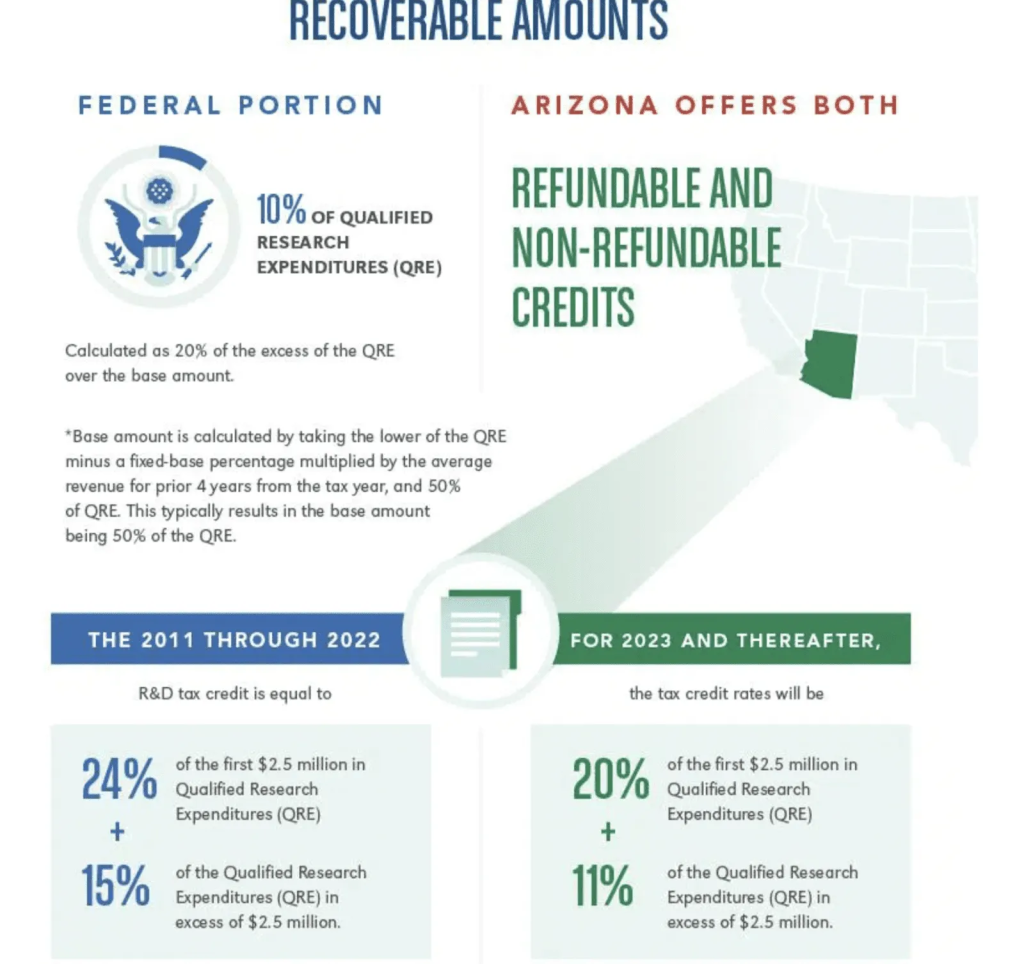

| Tax fees | $1M | |

| R&D deductions at 24% | $240k | |

Four broad categories define research and development work, also known as qualified research activities (QRAs). They include:

- Permitted purpose – Work done to develop new or improved products or processes

- Technological uncertainty – Work done to find a new solution or method that’s previously been unsolvable with publicly available information or knowledge

- Process of experimentation – Work done in a systematic process to evaluate one or more alternatives

- Technological in nature – Work done in physical sciences, biology, engineering, or computer science

The expenses that contribute to one or more of these categories, which are known as qualified research expenses (QREs), and count toward the tax credits include:

- Patents

- R&D supplies

- Salaries for US employees

- Salaries for US subcontractors

- Hosting costs (rentals for off-premise computers and other tech)

Logistics, All inclusive

Logistics, all inclusive

Logistics, all inclusive

Logistics, all inclusive

Logistics, all inclusive

Logistics, all inclusive

Logistics, all inclusive